A lot of the lenders on our record offer unsecured individual financial loans, but Areas also offers secured loans. After you have a secured mortgage as a result of Areas, you employ a Locations deposit account as collateral. You could borrow anywhere from $250 to 100% within your deposit account stability.

There are some techniques it is possible to borrow money with "terrible" credit rating. Possibilities contain: Crisis personal loans

You aren't gonna get paid any where around what you might in case you tried using marketing your system straight to a person.

Having said that, if a lender does share your account facts Together with the credit bureaus, that’s a distinct story.

TD Lender offers private loans of as much as $fifty,000 which might be in your banking account in just one particular company working day. Unlike numerous lenders, TD Bank prices no origination fees on its personal loans, which can help you help save 1000s of pounds.

Mainly because suggestions for these financial loans are established by the NCUA, credit score unions lawfully can’t demand greater than a 28% APR. Although this isn’t low-cost, it’s significantly much better than some other loans, such as a payday or title personal loan.

Get an extra facet gig or two and preserve up each and every dime you make with it just for those crisis situations. It will eventually add up as time passes.

If the credit rating is under stellar, using actions to further improve it can present you with far more alternatives the next time you need money rapid and haven't got enough in cost savings.

Here are some “quick-hard cash” selections you must stay much clear of. Although They could assistance your financial condition within the short-expression, it’s most likely they is likely to make it considerably worse during the prolonged-operate.

Borrowing money in this manner could be awkward and uncomfortable for each functions, particularly if the borrower has a hard time with repayment. But it could be definitely worth the pain to stay away from generating your financial predicament even worse with an expensive bank loan.

LendingPoint also considers more than just your credit score when figuring out mortgage eligibility, which could aid make loans much more accessible to some borrowers.

Regrettably, As outlined by Bankrate, greater than fifty percent of american citizens don’t have an unexpected emergency fund of at the least 3 months’ worthy of of expenses and twenty five% haven't any crisis fund in the slightest degree.

For those who website have a money benefit daily life insurance policy coverage like full or common existence insurance policy, you are able to borrow versus it at any time and repay it everytime you want.

As an example, For those who have gone a few or more years without the need of a collision, have taken defensive driving schooling, or simply make great grades, you might be able to get any place close to ten% off.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Katie Holmes Then & Now!

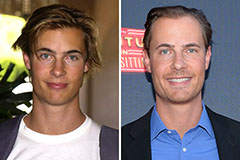

Katie Holmes Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!